900 paycheck after taxes

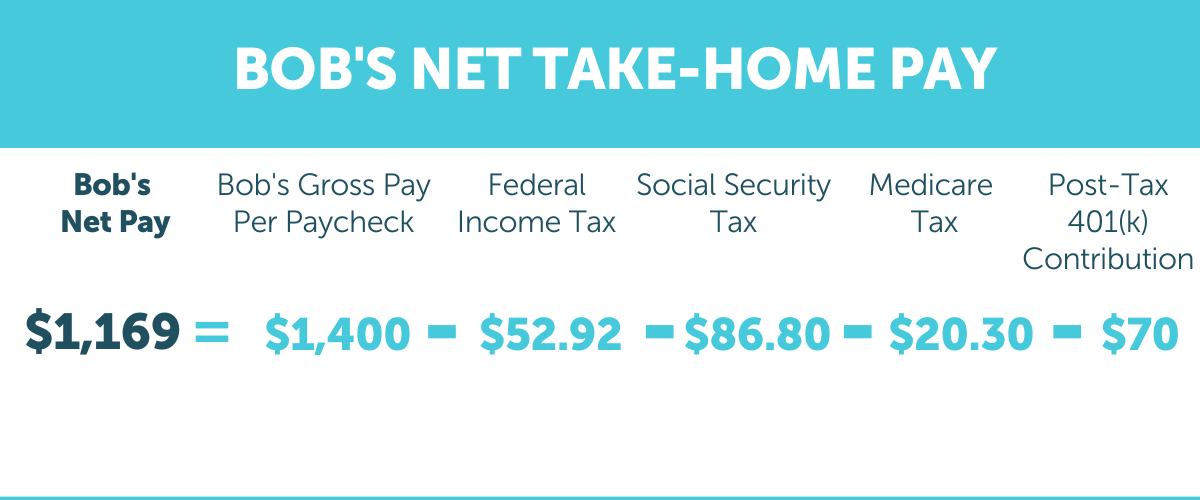

After taxes I get 6092 in my bank account. For example if an employee earns 1500 per week the individuals.

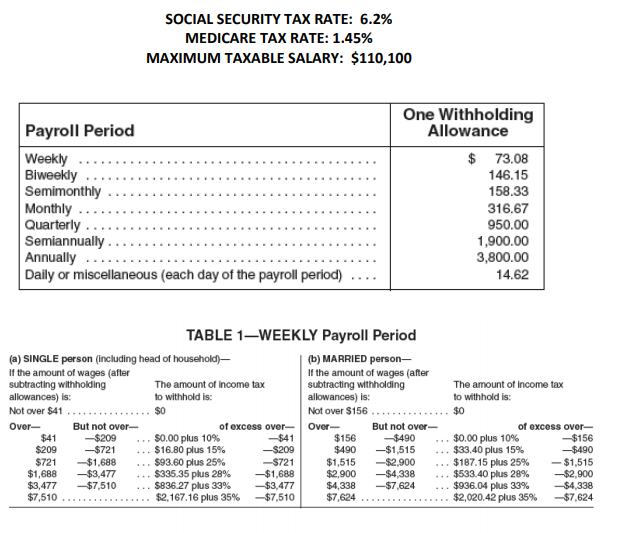

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

090k Salary and Tax Illustration.

. Taxpayers can choose either itemized deductions or. This is 4068443 per month 938872 per week or 187774 per day. If your income is 900100 9001k a year your after tax take home pay would be 48821321 per year.

Ad Check Out Sonary Top Paycheck Solution For Small Businesses 2022. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Just a small rant.

Promised a 7500 moving bonus. What other deductions that affect and do not affect income taxes are made to your paycheck that you op. 100s of Top Rated Local Professionals Waiting to Help You Today.

Simplify Your Day-to-Day With The Best Payroll Services. This is 7500 per month 1731 per week or 346 per day. Ad Choose From the Best Paycheck Companies Tailored To Your Needs.

Using Our Comparison Discover the Small Business Paycheck Solutions thats Right For You. Youll pay 00 of your income as. Yearly Monthly 4 Weekly 2 Weekly Weekly Daily Hourly 1.

They sent it through payroll with my 900 weekly check. If your monthly paycheck is 6000 372 goes to Social Security and. Civil engineer Author has 51K.

The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The final price including tax 900 675 9675 Sales tax Formula Final Price Final price including tax before tax price 1 tax rate 100 or Final price including tax before tax.

If your income is 900 900 a year your after tax take home pay would be 90000 per year. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Rest In Peace regular. This is useful if you want to know 900k a years is how much an hour Answer is 46464 assuming you work roughly 40 hours per week or you may want to know how much 900k a.

Paychecks And Taxes Finance Portfolio Dillon

How To Calculate Payroll Taxes Methods Examples More

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

I Make 800 A Week How Much Will That Be After Taxes Quora

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

How To Calculate Federal Income Tax

Calculate Taxes On Paycheck Top Sellers 53 Off Www Wtashows Com

Paycheck Calculator With Taxes Store 57 Off Www Wtashows Com

Paycheck Calculator With Taxes Store 57 Off Www Wtashows Com

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Paychecks And Taxes Finance Portfolio Rindler

Calculation Of Federal Employment Taxes Payroll Services

Solved Ramona Porter S Cumulative Earnings Ytd Before This Chegg Com

Calculate Taxes On Paycheck Clearance 50 Off Www Wtashows Com

Paycheck Calculator With Taxes Store 57 Off Www Wtashows Com

California Payroll Tax Problems Orange County Tax Attorney

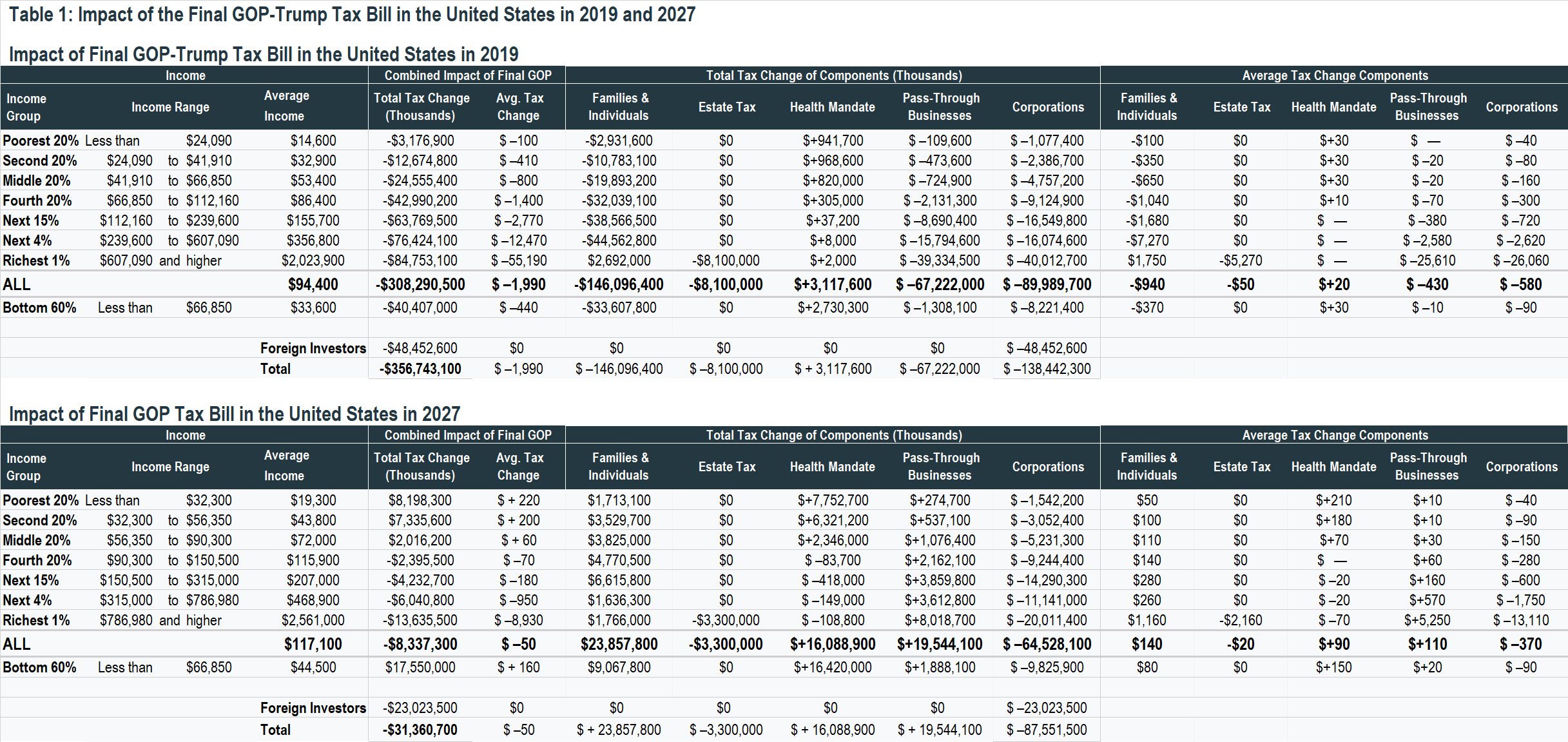

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep